What is my car’s value after an accident?

Blog/ What is my car’s value after an accident?

AuthorSarah RobinsonCategory Car Advice

Every driver hates the thought of getting in an accident, but we know that accidents happen every day. We hope that it will just be a fender bender, but what if it’s more than that? Once you’ve been in an accident and your car has been damaged, you need to know what your car is worth. Insurance companies don’t make this calculation easy, so here are some steps you can take to find out your car’s value after an accident.

How much damage is too much?

To begin with, just how damaged is your car? Frankly, it matters more how your insurance company has labeled the damage than what you think the damage is. When your insurance company made their valuation on your car, did they label it as salvaged or rebuilt? If so, this is going to significantly reduce your car’s value. Having a salvaged or rebuilt car means that your car was damaged to the point that it would have cost more than the car was worth to fix it.

When considering a new car, buyers will typically check sites like Carfax or AutoCheck to review the history of the car. Your accident will almost certainly show up on those sites, and many potential buyers are scared off by accident histories. A car with an accident history signals that the car needed repairs. Buyers are hesitant to purchase these cars because there’s no way for them to know exactly how much damage was done, what repairs were made, or how skilled the mechanic was.

Buyers are especially leery about sellers who are selling cars with a salvage or rebuilt title because those cars have clearly been very damaged or weren’t even worth much before the accident. When the demand for a car goes down, the value of the car goes down.

What if my car isn’t salvaged or rebuilt?

If your car isn’t salvaged or rebuilt, your next hurdle is how much damage still exists. A major consideration in determining your car’s valuation after an accident is whether or not you’ve had it repaired. If your car is still damaged and has not been repaired, it will be worth less than it otherwise would be. Buyers typically do not want to purchase a car that will be a hassle for them. They want a car that is already functional with as few problems as possible. Buyers do not want to run the risk of finding out that more things are wrong with it and having to spend more money to fix the car. You can expect some depreciation on your car after the accident.

How much does a car depreciate after an accident?

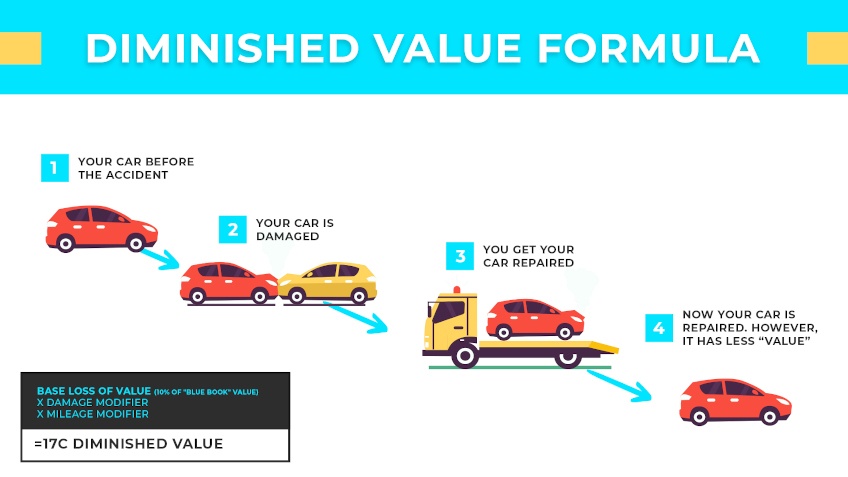

If you want to know a close estimate on your car’s depreciation after the accident, you will need to understand the 17c Diminished Value Formula. Don’t be scared off by the name. We’ll break it down for you.

The 17c Diminished Value Formula explained

The 17c Diminished Value Formula is used by insurance companies to determine a car’s valuation after an accident. Basically it’s used to figure out how much the car is worth after all of the damage.

The actual formula:

17c = Base loss of value (10% of Blue Book value) X Damage Modifier X Mileage Modifier

The formula broken down into steps:

-

Find out just how much your car was worth prior to the accident. You can check NADA or Kelley Blue Book to find your car’s value prior to the accident. You’ll just need to know the year, make, and model plus some basic information about mileage and the general condition of the vehicle.

-

Calculate the 10% cap that is immediately placed on your car’s value. Your insurance company sets the maximum payout amount at 10% of your car’s value. So no matter the amount of damage done in the accident, your insurance company will only pay out up to 10% of the car’s value. For example, if your car was worth $10,000 prior to the accident, your insurance company will only pay up to $1,000 in damages after the accident.

-

Multiply the number you got from step 2 by the Damage Modifier. The Damage Modifier takes into account the structural, but not mechanical, damage done to your car in the accident. To calculate the Damage Modifier, multiply the number from step two by:

- No structural damage: 0.0

- Minor structural damage: 0.25

- Moderate structural damage: 0.5

- Major structural damage: 0.75

So in our example with the car originally worth $10,000, we will say that it had moderate structural damage. Our 10% cap on that car was $1,000. $1,000 multiplied by the Damage Modifier would be $500.

- Multiply the number you got from step three by the Mileage Modifier. The Mileage Modifier takes into account the mileage on your car and reduces the value of your car based on the mileage. Higher mileage cars are worth less than cars with fewer miles. To calculate the Mileage Modifier, multiply the number from step three by:

- 0-19,999 miles: 1.0

- 20,000-39,999 miles: 0.8

- 40,000-59,999 miles: 0.6

- 60,000-79,999 miles: 0.4

- 80,000-99,999 miles: 0.2

- 100,000+ miles: 0.0

So in our example with the car originally worth $10,000, we will say that it had 70,000 miles. We will take the number from step three ($500) and multiple it by 0.4. Our final number based on the Mileage Modifier is $200.

What about my car?

To figure out the exact numbers on your car, head on over to our accident calculator to find out the diminished value of your car. This will let you find out the exact amount that your car is worth after your accident.

If this all seems like too much work to sell your damaged car, we can save you the trouble. We buy cars throughout the entire United States from Texas, to California and more. Call SellMax for a quote or use our online form to get an instant offer.